prince william county real estate tax payments

Payment of the Personal. Then they get the assessed value by multiplying the.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county.

Median Property Taxes Mortgage 3893. Get Record Information From 2022 About Any County Property. Prince William County Virginia Home.

If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. Payment by e-check is a free service. What is the penalty if I pay my property taxes late in Virginia County Prince William.

If you have not received a tax bill for your vehicles contact the. Make checks payable to Prince. This estimation determines how much youll pay.

Click here pay online. How property tax calculated in pwc. A convenience fee is added to payments by credit or debit card.

Personal Property Taxes Due October 5 2022 Prince William County Personal Property taxes for 2022 are due on October 5th. Monday - Friday 830 am - 430 pm. The Prince William County Department of Finance reminds residents that personal property taxes are due on or before Monday Oct.

In Prince William County. Prince William County Virginia Home. All you need is your tax account number and your checkbook or credit card.

Ad Pay Your Taxes Bill Online with doxo. Personal Property Taxes Due October 5 2022 Prince William County Personal Property taxes for 2022 are due on October 5th. Correspondence and Tax Payments.

1-888-272-9829 enter code 1036. The Manassas City Council voted Monday to slash property tax bills on motor vehicles by 15 and extended the deadline for payment by three weeks to Oct. Contact the Real Estate Assessments Office Available M.

If you have questions. Occasionally the billing information on file is incorrect and a real estate tax bill that should have been sent to a. How The Payment Process.

July 2 2022. By creating an account you will have access to balance and account information notifications etc. Ad Find Prince William County Online Property Tax Bill Info From 2022.

If you have not received a tax bill for your vehicles contact the. Prince William County Tax Administration Division PO Box 2467 Woodbridge VA 22195-2467. You can pay a bill without logging in using this screen.

The County bills and collects tax payments directly from these companies. Prince William County Property Tax Payments Annual Prince William County Virginia. Proceso de pago en espanol.

Hi the county assesses a land value and an improvements value to get a total value. Provided by Prince William County Communications Office. Prince William County collects on average 09 of a propertys.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. If you have questions about this site please email the Real Estate. Learn all about Prince William County real estate tax.

Teléfono 1-800-487-4567 entrando código 1036. Search 703 792-6000 TTY.

Prince William County Data Center Site Sells For 74 5 Million Dcd

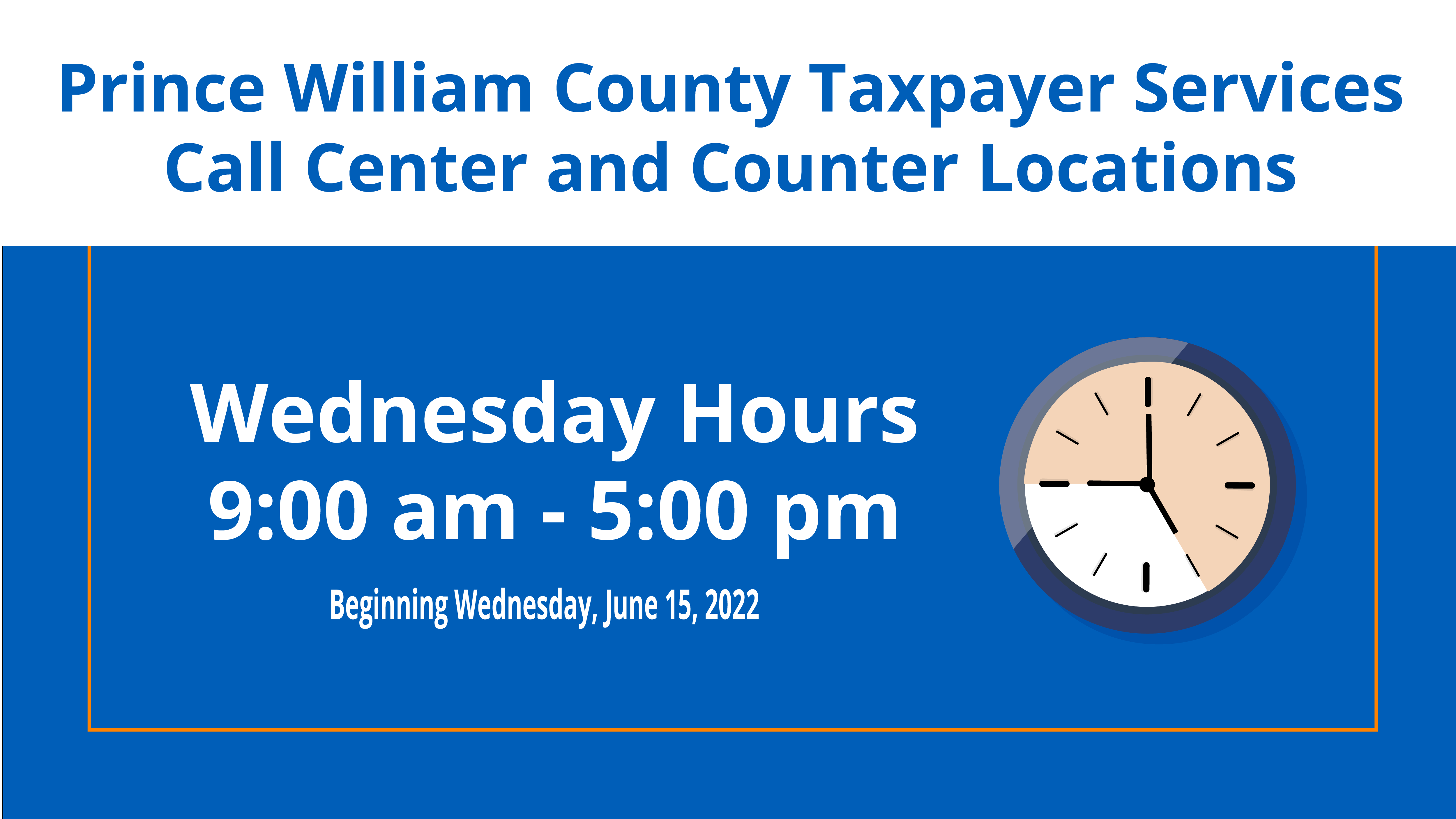

New Hours For Taxpayer Services Call Center And Counter Locations

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Landfill And Compost Facility Safety Guidelines

Explore Prince William County Parks This Summer With The Pwc Parks Explorer Pass

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Less Taxes Less Spending Prince William Residents Decry Proposed Hike In Tax Bills Headlines Insidenova Com

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

5 Things Agents Need To Know About The Tax Grievance Process Property Tax Grievance Heller Consultants Tax Grievance

Hireground Inc To Participate In Pwc Gives Prince William Living

Join Renew Realtor Association Of Prince William

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William County Real Estate Taxes Due July 15 2022

Prince William County Planning Commission Approves Data Center Between Manassas And Gainesville Headlines Insidenova Com